NEW PRODUCT LAUNCH — TRAVEL INSURANCE —

NEW PRODUCT LAUNCH — TRAVEL INSURANCE —

Phase 1 — Direct Travel Insurance

Product requirements

The product needed to be launched quickly into a complex and highly regulated category, adding an entirely new insurance line to an existing portfolio. It had to integrate cleanly with an established product and technology stack, support both direct travel insurance purchases and be built to bundled home insurance journeys for Phase 2 of the project.

Providing a clear, trustworthy experience in a market known for confusion, drop-off, and poor self-service was also key.

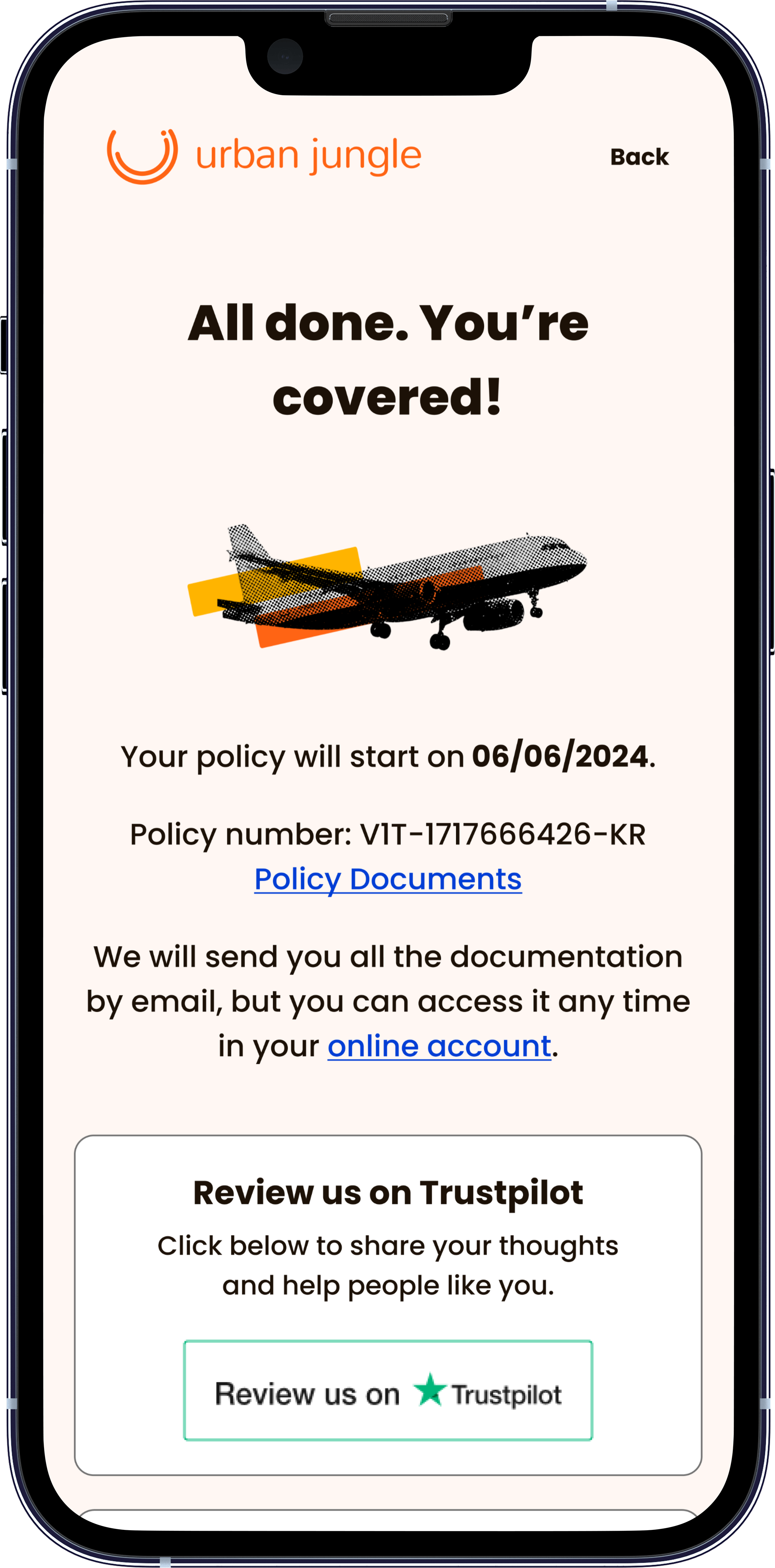

Launch

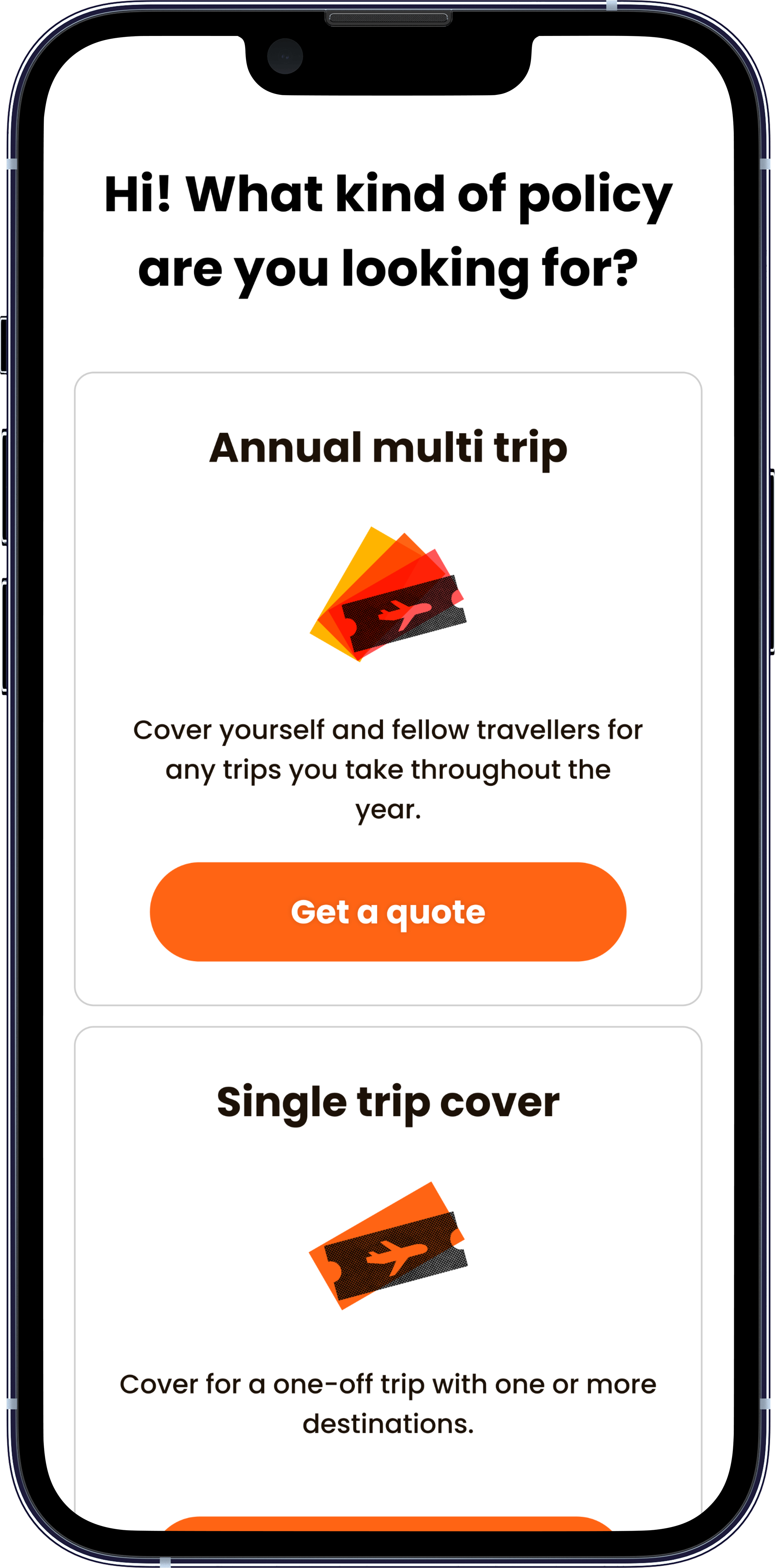

An off-the-shelf V1 travel insurance product was launched to validate demand and unlock immediate revenue, offering streamlined direct journeys for Single Trip and Annual Multi-Trip customers.

The experience was designed to outperform industry standards, with fully online mid-term adjustments, integrated medical screening via Verisk, and tight alignment with existing infrastructure. Products were built with the ability to expand in Phase 2 with cross-sell.

Overview

I led the design and launch of a new Travel Insurance product in partnership with PJ Hayman, taking it from concept to market at speed.

The goal was to launch an off-the-shelf V1 that unlocked immediate revenue, validated cross-sell potential, and laid the groundwork for a deeper, long-term partnership — without compromising on customer experience.

This product has since grown into a high-performing add-on, scaling 20–30% month-on-month with average transaction values consistently above budget in its first year.

Key features

Industry-Leading MTAs (Mid-Term Adjustments)

Travel insurance MTAs are rarely handled well – or even offered – online.

In response, we followed our existing UX standards across our product offering and:

Designed fully online MTA flows including integrated medical re-screening

Allowed customers to amend trips without support calls

Delivered a significantly better UX than industry norms

This reduced operational load and improved customers’ ability to self-serve.

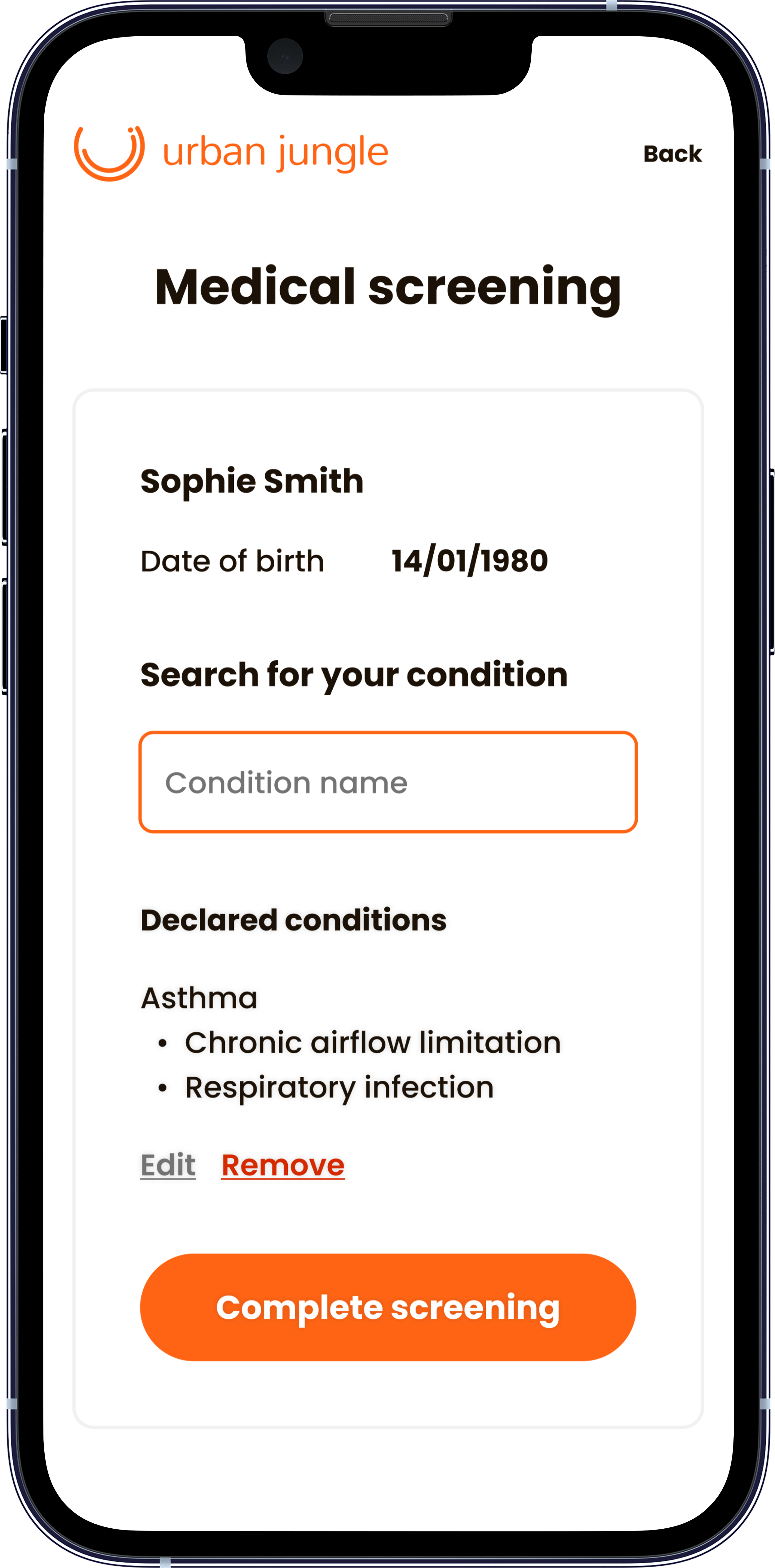

Medical Screening Integration

Medical screening is one of the biggest drop-off points in travel insurance with many insurers requiring users to call to declare conditions. It is also a sensitive experience requiring a high trust threshold as users are required to declare personal medical information.

I designed and integrated a real-time medical screening flow using Verisk, an external medical risk platform which was:

Embedded seamlessly into the journey

Provided clear, empathetic language around medical disclosure

Added minimal disruption to the purchase flow

The result was a compliant, trustworthy experience that didn’t feel punitive or intimidating.

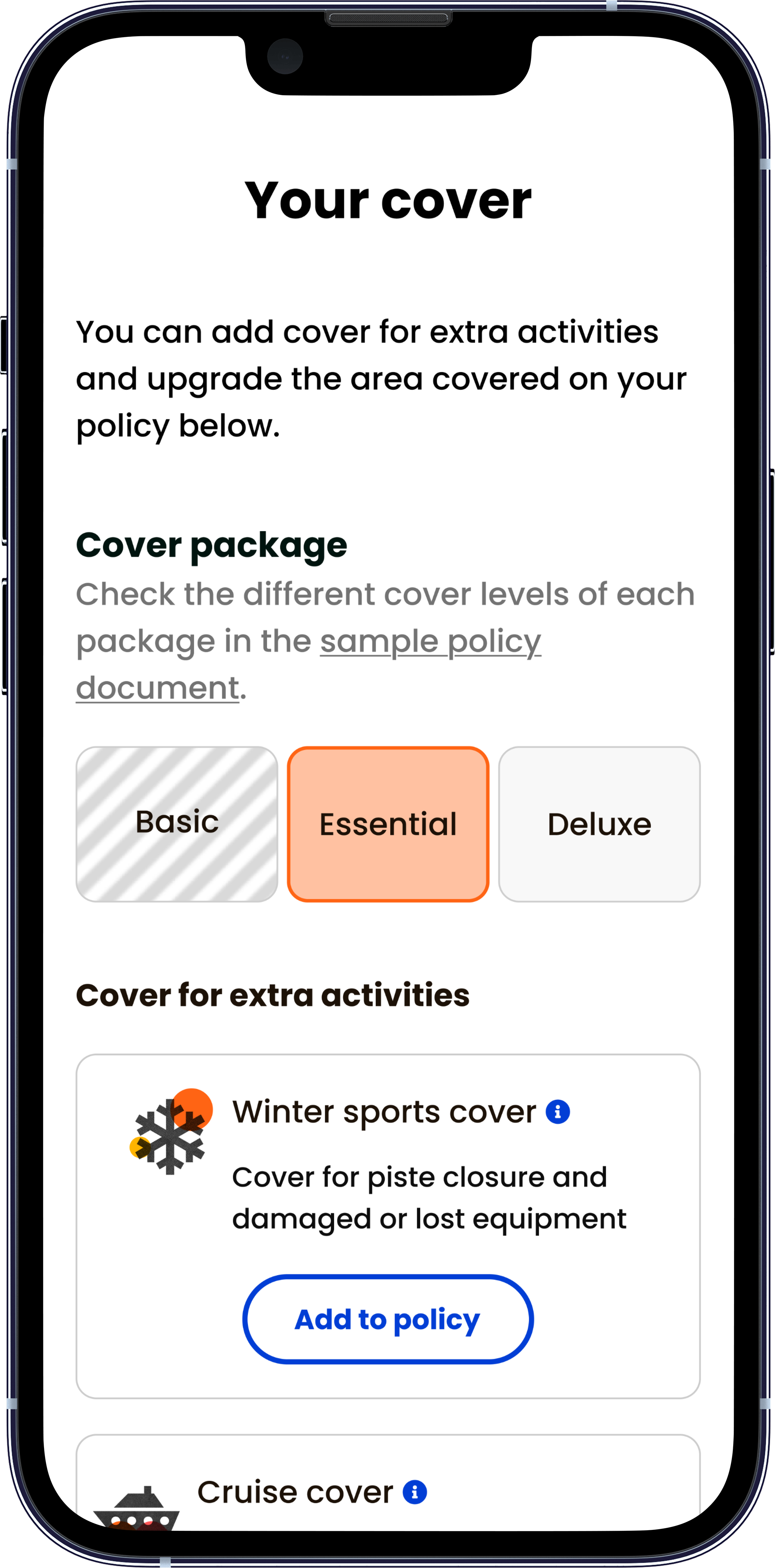

Design System & Brand Evolution

Alongside the product work, we used travel insurance as an opportunity to extend our existing design system. We:

Expanded the design system with travel-specific UI patterns and components

Extended the UI library and Tailwind asset library to enable rapid, consistent delivery

Introduced new branding elements, icons, and micro-interactions

Designed transactional and marketing email templates for onboarding, servicing, and renewals

The result was a cohesive, scalable system that aligned product and marketing touchpoints while supporting future growth.

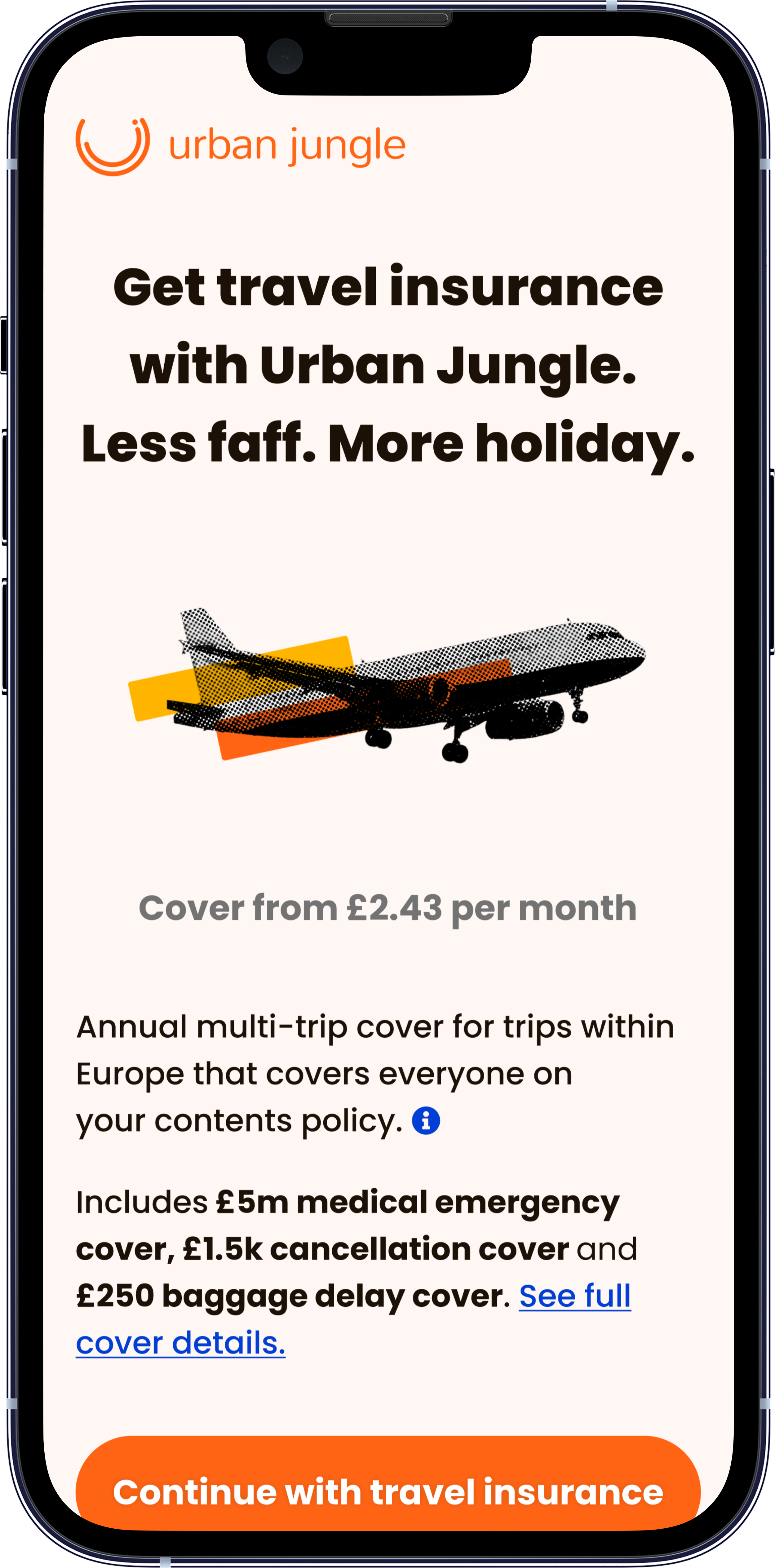

Phase 2 — Travel as a Home Insurance Add-On

Product requirements

The second phase focused on unlocking travel insurance as a natural extension of the home insurance journey, without adding friction or duplicating effort for customers. The product needed to sit seamlessly within the existing home purchase flow, share data and infrastructure, and feel like a single, cohesive checkout experience rather than an upsell.

Launch

Travel insurance was introduced as an optional add-on during the home insurance journey, allowing customers to purchase home and travel cover in one transaction. The experience reused the Phase 1 travel foundations — pricing, medical screening, and servicing — while adapting the UX to be contextual, lightweight, and non-disruptive.

This approach unlocked a new acquisition channel and drove sustained month-on-month growth, proving the effectiveness of bundled insurance at point of purchase.